Yes, air conditioning financing is available for individuals with bad credit in Florida.

As temperatures in Florida soar to new heights, air conditioning becomes an absolute necessity.

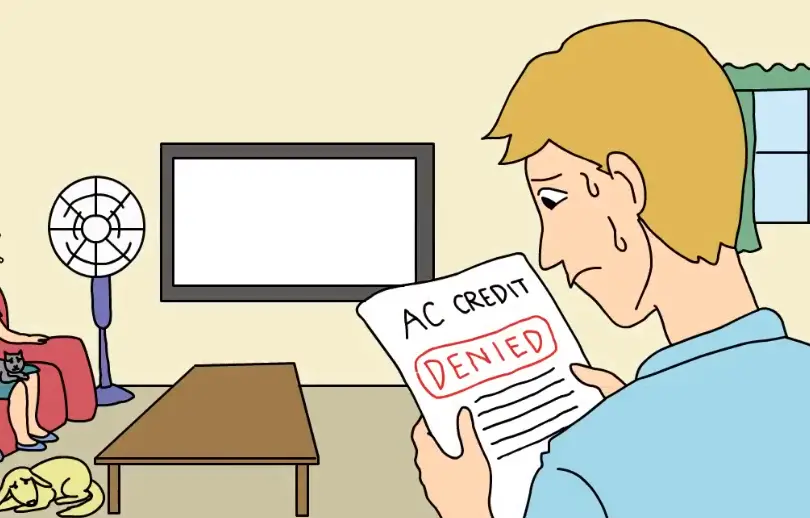

Unfortunately, not everyone has a perfect credit score, and bad credit can make it difficult to secure financing for much-needed HVAC systems.

But fear not, because there are still options for those with less-than-perfect credit scores.

In this blog post, we will explore the world of air conditioning financing for bad credit in Florida and the obstacles that come with it.

How to Overcome the Obstacles of Air Conditioning Financing Bad Credit in Florida?

Overcoming the obstacles of air conditioning financing bad credit in Florida can be challenging but not impossible.

Check out the following tips to improve your credit score and plan to get no credit check air conditioning financing.

Firstly, assessing your credit score and identifying ways to improve it is important. Make timely payments, reduce credit card balances, and avoid new credit applications.

Secondly, research various financing options available in the market, such as secured loans, peer-to-peer lending, or personal loans.

Consult with HVAC professionals for guidance on the best financing options for your situation.

Thirdly, consider seeking professional help from credit counseling agencies or financial advisors to guide you toward your best options.

Another alternative to obtain financing could be to negotiate with the air conditioning company for a payment plan or a lower interest rate.

Additionally, consider negotiating with financiers to secure better terms, such as lower interest rates or longer repayment periods.

Lastly, ensure you have a stable source of income, as lenders will evaluate your current financial situation before approving any financing.

Remember that regular payments on your financing plan are always a smart idea if you want to raise your credit score and secure future financing chances.

How Can You Get No Credit Check Air Conditioning Financing?

If you are looking for no credit check air conditioning financing, there are a few options you may consider.

Firstly, you can research companies that offer financing without credit checks online.

Secondly, you can contact local HVAC companies that offer financing programs to see if they offer no credit check options.

Some credit unions and community banks may offer no credit check financing programs.

When considering these financing options, it is important to be cautious of high-interest rates and fees.

It may also be helpful to improve your credit score over time to increase the likelihood of being approved for lower interest rates and better financing options.

FAQs On Financing Bad Credit In Florida

Let’s find some of the most frequently asked questions on financing bad credit in Florida below to overcome your financial obstacles.

What Credit Score Do You Need to Finance an AC Unit?

Having good credit is often essential to get approved for financing an AC unit.

Generally, lenders look at your credit score to determine if you qualify for a loan and what terms they can offer you.

A good rule of thumb is that the minimum credit score needed to finance an air conditioner should be around 680 or higher.

How much is AC in Florida per month?

The cost of air conditioning in Florida can vary greatly depending on several factors.

The size of the home or business, unit type, and usage level can all impact monthly costs.

On average, homeowners in Florida can expect to pay between $100 and $300 per month for air conditioning usage during the summer months.

Should I Finance a New AC Unit?

When it comes to deciding whether you should finance a new AC unit, there are several factors to consider.

First and foremost, the cost of a new air conditioner can be substantial, so financing may be your only option if you’re already dealing with financial constraints.

Additionally, if your current AC unit is more than 10 years old and not working as efficiently as it once did, then investing in a newer model may save you money in the long run due to its improved efficiency.

On the other hand though, if your current AC is still relatively functional and energy-efficient but needs some repair work done on it instead of replacing the entire system; then financing might not make sense for you since repairs are usually much less expensive upfront.

Ultimately, when making this decision, it’s important that you weigh all of these factors carefully and also consider any special offers or discounts available before signing off on any loan agreement.

Air Conditioning Loans | Air Conditioning Repairs Financing | Orlando | Good and Bad Credit

Conclusion

In conclusion, air conditioning financing with bad credit in Florida is a great option for those who may have experienced financial difficulty in the past or are currently struggling with their finances.

With the help of lenders that specialize in helping people with bad credit secure loans, it’s possible to get your home cooling needs taken care of despite not having an ideal credit score.

Be sure to do your research and find the best lender for you before committing to any agreement as there can be additional fees and costs associated with certain loan providers.