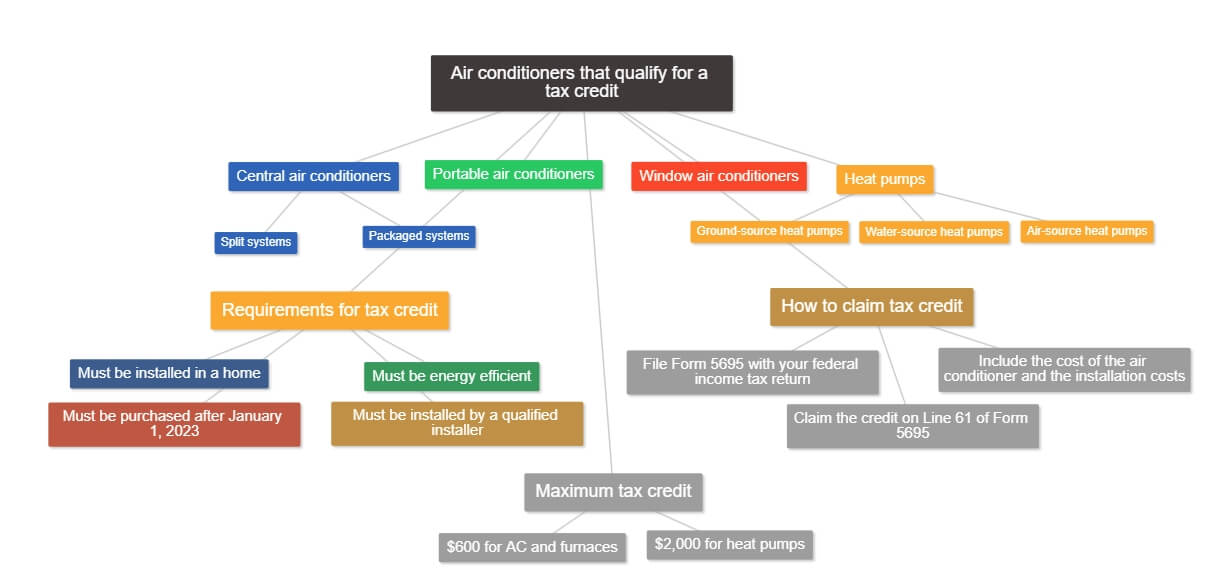

In order to qualify for a tax credit, an air conditioner must meet certain energy efficiency standards set by the U.S. Department of Energy. For central air conditioners, the minimum SEER (Seasonal Energy Efficiency Ratio) must be 14. For room air conditioners, the EER (Energy Efficiency Ratio) must be 12.

The U.S. government offers tax credits for certain types of air conditioners, as part of its effort to encourage energy efficiency. To qualify for the tax credit, an air conditioner must meet certain standards for energy efficiency as set by the Department of Energy. Air conditioners that meet the criteria for the tax credit can save homeowners money on their energy bills, and they also help to reduce emissions of greenhouse gases.

If you’re considering buying a new air conditioner, be sure to check whether it qualifies for the tax credit.

What Hvac Qualifies for Tax Credit 2022?

The 2022 tax credit for HVAC systems has not yet been determined. The credit is typically based on the energy efficiency of the system, with more efficient systems qualifying for a larger credit. In 2021, HVAC systems that meet certain energy efficiency standards can qualify for a tax credit of up to $300.

What Ac Units Qualify for Tax Credit?

The American Recovery and Reinvestment Act (ARRA) of 2009 offers tax credits for energy efficiency improvements. That includes qualifying central air conditioners installed in your primary residence between January 1, 2009 and December 31, 2010. The credit is equal to 30% of the cost of the unit, up to $1,500.

To qualify, the central air conditioner must meet or exceed Energy Star qualifications which are set by the U.S. Department of Energy (DOE) and the U.S Environmental Protection Agency (EPA). Presently, that means a Seasonal Energy Efficiency Ratio (SEER) rating of 14.5 or greater; and an Energy Efficiency Ratio (EER) rating of 12 or greater.

What Hvac System Qualifies for Tax Credit 2023?

As of January 1, 2023, homeowners who install a new central air conditioning system may be eligible for a federal tax credit. The credit is worth up to $300 and can be applied to both the purchase and installation of the unit. In order to qualify, the air conditioner must meet certain energy efficiency standards set by the government.

Additionally, the tax credit is only available for systems that are installed in homes that are used as primary residences. There are a number of different HVAC systems on the market that meet the criteria for the tax credit. Some of the most popular brands include Trane, Carrier, Lennox, and Rheem.

These companies make a variety of different models that vary in features and price. Homeowners should consult with a licensed contractor to determine which system is best for their home and needs. Installing a new central air conditioning system can be a big investment.

However, with the federal tax credit, homeowners can save money on both the purchase and installation of their unit. This makes it an attractive option for many people who are looking to improve their home’s energy efficiency.

What Home Improvements are Tax Deductible in 2022?

The answer to this question may vary depending on the country in which you reside. In the United States, for example, some home improvements that are tax deductible in 2022 include energy-efficient upgrades, repairing damage from a natural disaster, and making your home more accessible for people with disabilities.

However, it is always best to speak with a tax advisor to determine which specific upgrades will qualify for a deduction.

What Appliances Qualify for Energy Tax Credit?

When it comes to saving money on your energy bill, there are a number of tax credits available for qualifying appliances. The Energy Tax Credit is one way that you can save money on your energy costs, and it can be used for both residential and commercial appliances. Here’s what you need to know about the Energy Tax Credit and which appliances qualify.

What Is the Energy Tax Credit? The Energy Tax Credit is a credit that’s available to taxpayers who purchase qualifying energy-efficient products. The credit is designed to encourage people to use more energy-efficient products in their homes and businesses, which can help save energy and money.

Can You Write off a New Ac Unit on Your Taxes?

The short answer is no, you cannot write off a new air conditioner on your taxes. However, there may be some cases where you can get a tax credit for energy-efficient appliances, which could include an AC unit. Energy Star is a joint program of the U.S. Environmental Protection Agency and the U.S.

Department of Energy that helps consumers save money and protect the environment by identifying energy-efficient products.

Does 14 Seer Qualify Tax Credit

If you’re looking to improve your home’s energy efficiency, you may be wondering if a 14 SEER air conditioner qualifies for the tax credit. The answer is yes! The 14 SEER rating means that the unit is 14% more efficient than a standard AC unit, which makes it eligible for the tax credit.

The tax credit can save you up to $1500 on your purchase of a new AC unit, so it’s definitely worth considering if you’re in the market for a new one. If you have any questions about whether or not your AC unit qualifies for the tax credit, be sure to consult with a qualified HVAC professional.

What Seer Rating Qualifies for Tax Credit 2023

The tax credit is based on the energy efficiency of the home as indicated by its seer rating. A home with a seer rating of 13 or higher qualifies for the 2023 tax credit. The maximum credit is $2,000 for new construction and $1,500 for existing homes.

INFLATION Reduction Act Means MONEY for HVAC!

Does 16 Seer Ac Qualify for Tax Credit?

If you’re thinking about upgrading your air conditioner to a more energy-efficient model, you may be wondering if a 16 SEER AC unit qualifies for the federal tax credit. The answer is yes! A 16 SEER air conditioner meets the minimum efficiency requirements for the tax credit, so you can enjoy some money back on your purchase.

Of course, there are other factors to consider when choosing a new air conditioner, such as cost and size. But if you’re looking for an energy-efficient option that can save you money in the long run, a 16 SEER AC unit is a great choice.

What Qualifies for Energy Tax Credit?

If you’ve made energy-efficient improvements to your home, you may be eligible for a tax credit. The credit is available for certain types of insulation, windows, doors, roofing, heating and cooling systems, and water heaters. To qualify for the credit, the improvements must meet certain criteria set forth by the Department of Energy.

For example, windows must be ENERGY STAR certified and installed between January 1, 2015 and December 31, 2016 to qualify. There are also requirements for installation costs and maximum tax credit amounts. You can claim the tax credit on your federal income tax return.

Be sure to keep receipts and other documentation of your purchase and installation to support your claim.

Energy Star Tax Credit

If you’re thinking about making energy-efficient improvements to your home, you may be eligible for a tax credit through the Energy Star program. The Energy Star Tax Credit is available for qualifying products that are installed in homes between January 1, 2017 and December 31, 2020. To be eligible for the tax credit, the product must meet certain energy efficiency requirements as determined by the U.S. Environmental Protection Agency (EPA).

Additionally, the product must be installed in your primary residence (not a rental property) and it must be used for personal use (not business use). Some of the qualifying products that could earn you a tax credit include:

* Insulation materials

* Exterior doors and windows

* Roofing materials

* Heating, ventilation, and air conditioning (HVAC) systems

* Water heaters

Improving the energy efficiency of your home can save you money on your utility bills and help reduce your carbon footprint. And with the Energy Star Tax Credit, you could receive a significant discount on these improvements.

Be sure to consult with a qualified tax professional to determine if you qualify for this credit and how much it could save you on your taxes.

What Hvac System Qualifies for Tax Credit 2022?

If you’re looking to upgrade your HVAC system and want to know if you qualify for a tax credit, the answer is maybe. The tax code changes frequently, so it’s important to stay up-to-date on the latest credits and deductions. For 2022, there are a few energy-efficient HVAC systems that may qualify for a tax credit.

First, let’s look at what defines an energy-efficient HVAC system. The U.S. Department of Energy (DOE) has standards for both central air conditioners and furnaces. To earn the DOE’s Most Efficient label, a product must meet strict energy efficiency criteria set forth by the agency.

This includes meeting a minimum SEER rating (Seasonal Energy Efficiency Ratio) and AFUE rating (annual fuel utilization efficiency). SEER measures how much cooling a system delivers per dollar of electricity used, while AFUE measures how much heat a furnace produces from the fuel it consumes. Now that we know what qualifies as an energy-efficient HVAC system, let’s take a look at which ones might be eligible for a tax credit in 2022.

Central air conditioners with a SEER of 16 or higher may qualify for a $300 federal tax credit if they meet certain other requirements set by the DOE. Gas furnaces with an AFUE rating of 95% or higher may also qualify for this $300 federal tax credit if they meet additional requirements specified by the IRS.

Geothermal heat pumps and solar water heaters also have the potential to earn federal tax credits in 2022, though the amount varies depending on the specific product and installation costs.

These credits are available through December 31, 2023, so there’s still time to make your purchase if you’re thinking about upgrading your HVAC system this year!

Conclusion

The bottom line is that if your air conditioner meets the requirements for a tax credit, you can get up to $300 back on your taxes. That’s a pretty significant savings, so it’s definitely worth looking into if you’re in the market for a new AC unit. Do your research and talk to your tax preparer to make sure you get the most out of your tax return.